Article

Effective User Research on a Bootstrapped Budget

Think your product development is inhibited by the lack of a research budget? Think again. Learn the best tactics for low-budget research.

When budgets and timelines need to be trimmed, it’s the tasks with intangible outputs that are cut first. Time and time again, in the name of urgency or cost, research budgets are scrapped and user testing is pushed out – sometimes indefinitely. But pushing this research and testing to the end of a development phase (or skipping it entirely) isn’t as quick and low cost as it sounds. Not spending those dollars up front increases the risk that your product will flop or that key insights will be missed. And that can mean missed opportunities for growth, or worse yet, missed sales quotas and financial losses for the company. We all remember Juicero, right?

To make matters worse, the late-stage changes needed to correct misdirected designs always cost significantly more than adapting your design early on.

Here at M3 Design, going in “eyes wide shut” just isn’t an option. So even when budgets don’t allow for larger research efforts, we are adamant that minimal levels of user research and testing are performed. In our experience, research activities don’t have to be massive, multi-week efforts consuming hundreds of thousands of dollars and an entire team’s time. Of course, there are occasions and projects where that is appropriate, but big impact and insightful discoveries can come from relatively low investment activities.

Determine when to bootstrap user research for your product

There are many, many projects that can benefit from bootstrapping research, especially when the alternative is no research at all. However, there are occasions where more in-depth research is required. If one of these applies to your product, more research is likely warranted:

- Your product is highly innovative and confidential in nature.

- There are significant business risks associated with your product’s launch – i.e., inventory costs are huge or post-launch changes are not possible.

- Your user is an “expert” with specific knowledge or experience necessary for using your product – i.e., a neurosurgeon using procedure-specific devices designed for surgery.

- Your product has multiple “hidden” stakeholders – i.e., an endoscope that is purchased, cleaned, prepped, and used by different parties.

- Your product requires disclosure of private information – i.e., a personal finance app that tracks spending habits.

- Use of your product is dependent upon other devices and/or services – i.e., a wearable medical device that requires a prescription and servicing at a hospital.

- You’re broadly exploring the future of an industry or product line for next-gen development – i.e., analyzing the future use of AR in workplace settings.

For everything else, there’s bootstrapping.

Get resourceful to conduct cost-effective user research

Some user research needs to be conducted at the foremost stages of a project. These activities are truly research oriented and focus almost entirely on discovery of foundational principles. This type of research is critical as it informs not only the design of the product but how trade-off decisions will be made at later stages. Insights can even lead to significant changes in your business model by illuminating assumptions and uncovering gaps in the market where new features or new products are sure to make a difference. Don’t skip it.

Learn from those that came before you

If you aren’t able to send a team into the field to observe users directly, you aren’t totally hosed. First-hand information is higher quality, but there are other methods for collecting essential data points. The first place to start is with your competition. If they have a product, then they have users… most likely ones that you’re ultimately hoping to convert to sales prospects anyway. So look for competitive products, brochures, educational videos or training content, and especially testimonials posted online.

There is a veritable wealth of information on sites like Amazon and Youtube, where you can glean insights directly from customers. Whether it’s an unboxing video for a new consumer product or an instructional video for a medical technique, video posts allow you to watch users interact with devices and offer their unreserved feedback. Written product reviews, posted on retail sites, provide a never-ending stream of customer commentary ripe for scrubbing through. Reviewers provide their opinions on everything from product features to workflow issues to customer service interactions. Paying attention to where users struggle or what intrigues them can reveal significant insights – just be wary of the overly positive, gleaming reviews. Blatant bias doesn’t help anyone develop a product.

So then, what do you reference when your product is truly unique and has no direct competitors? Analogous activities – they are sure to exist, and you’ll either be able to participate in them directly or, at a minimum, observe the environment and the people that flow through it. For example, in designing the space for an innovative batting bay experience, the M3 team studied the business model of Top Golf, the customer experience of bowling alleys, and the design of batting cages. While none of these businesses is an exact match, the types of challenges faced and the solutions implemented still represent an incredibly valuable reference point. Exploring the details and thinking through the “whys” of what you observe can create a strong base of knowledge to build upon.

Develop empathy to build better mental frameworks

Pouring through observational data is a great starting point, but it can be inadequate when trying to build a deeper understanding of your user’s experience. Reading reviews and scoping out competitors is informative, but it mainly provides data on feature sets and design styles. A healthy NPD process goes deeper into the user’s experience, leading to concepts that get to the root of user needs. So when budgets are tight but more context is needed, have your team conduct empathy-building exercises. Again, just to really hammer it home, conducting direct interviews with real users should be your primary source of information. But when that’s just not a possibility, using experience mapping and bodystorming techniques can reveal empathic insights that better inform your product’s design.

Experience maps are great tools for exploring the emotional states, thoughts, and activities that customers associate with a general scenario. This exploration provides a more detailed and vibrant contextual framework for your team to reference as they begin concept development. Good experience maps chart a generic user’s flow through sequential activities. And, they’re used to really drill down on touchpoints with a product. Have your team and a few independent reviewers meet for 1-2 hours to talk through the user workflow and the typical interactions that would be experienced. If any significant pain points are uncovered, highlight those as development challenges for your team.

If you’re curious about how we at M3 immerse ourselves in a product’s user experience, download our experience mapping template below.

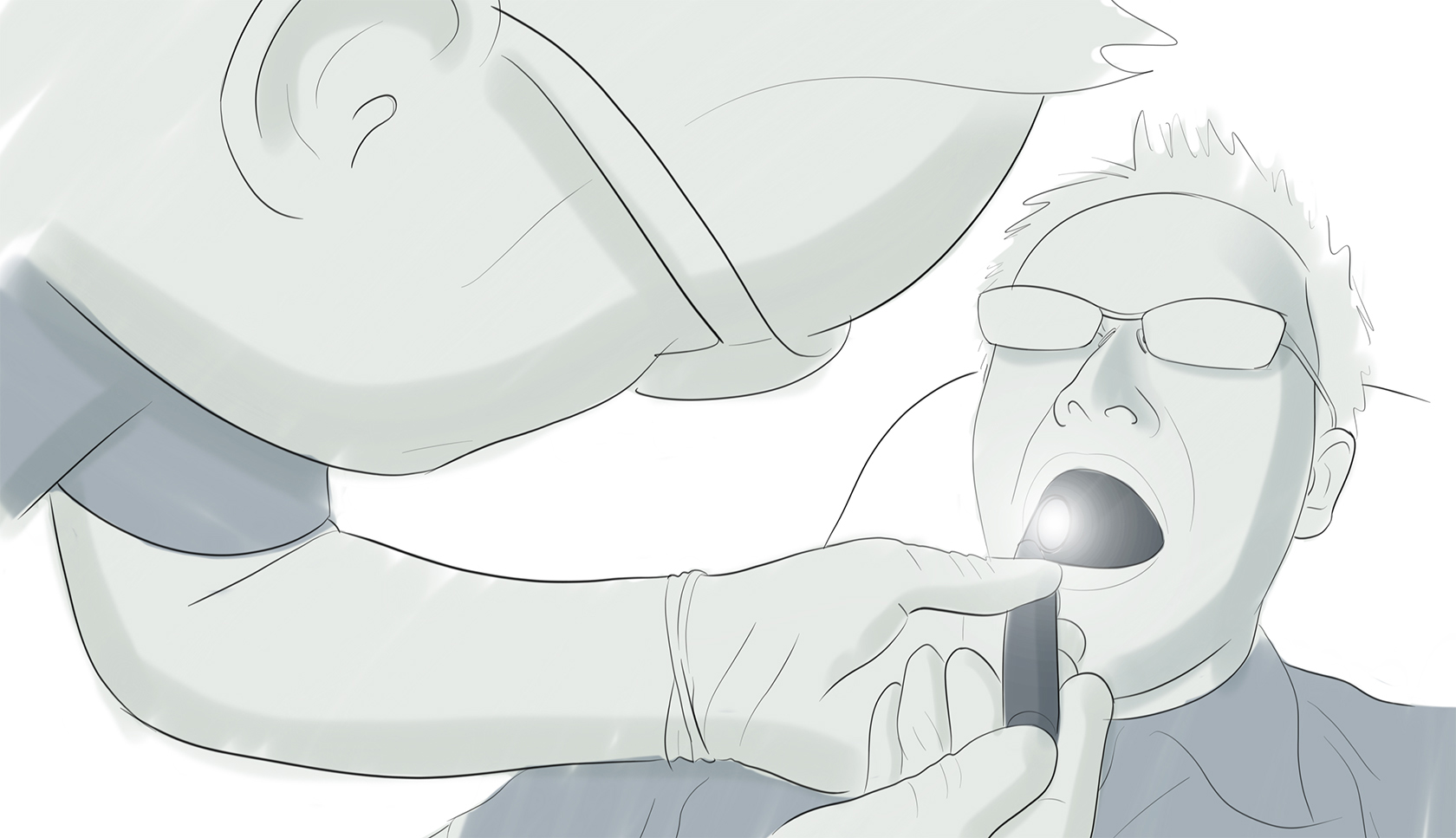

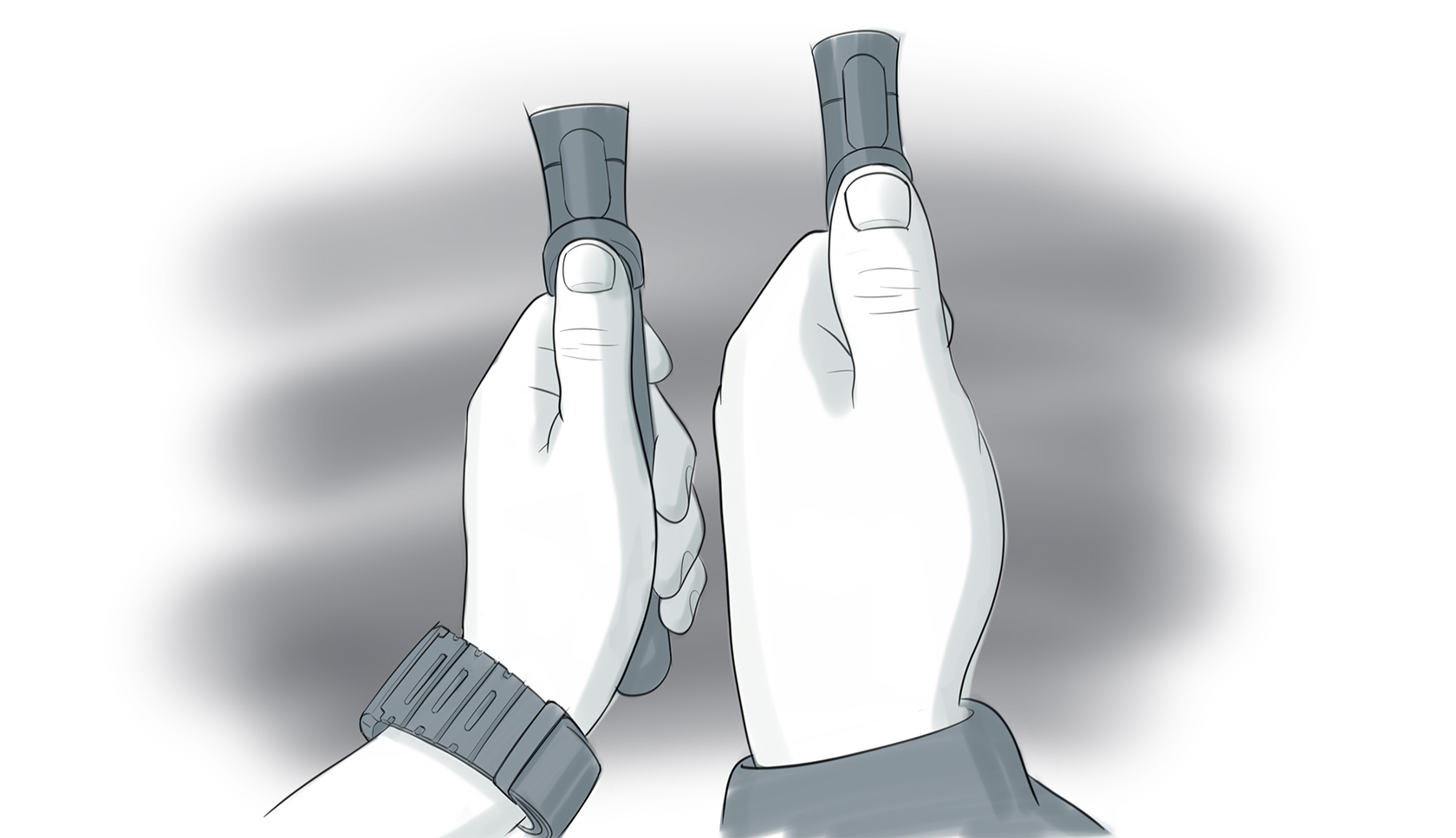

Bodystorming is a technique that requires teams to personally experience a product use case. It is best suited to products that require a specific, definable set of actions, as those are easiest to replicate. With only a few hours of time, a little playful curiosity, and one or two off-the-shelf products, your team can immerse themselves in a user’s shoes and gain real perspective. For instance, when designing an oral cancer screening tool for Star Dental, the M3 team used a standard lighted mirror to evaluate the ergonomics and challenges associated with conducting a dental examination. By actually using the device and conducting “examinations” on fellow M3’ers, the team built an in-depth understanding of the product’s general use-environment. Ultimately, this led to actionable output and a patentable design for the central touchpoint of the product.

Think small to solicit low-cost user feedback

There comes a time in every project’s life where background research needs to be supplemented with actual user testing. It’s one thing to form a strategy at the start, but validating that strategy and how it has been implemented is a whole other monster. Don’t assume your team distilled the initial user research 100% perfectly and integrated it flawlessly into your product. The reality is, your team designed the product – they understand the intent behind every feature, the history and reason for every minute detail. And, for precisely that reason, they are incapable of providing unbiased feedback. Being experts on how to use a device doesn’t make them experts on how usable your device is. So gather feedback from users instead.

Budget-friendly methods to get in touch with actual users

If you’re looking for low-cost, low-touch options for user research, online surveys are a perfect place to start. There are tons of online resources available that make this process incredibly quick and simple, but there is a catch. Data from the wrong “users” can be misleading and confound your results. So spend some time thinking through screening questions to ensure you get connected to the right people. In our experience, the best screeners eliminate the use of jargon, keep questions close-ended, and are as specific as possible. Similarly, thinking through how you intend to use your data later on can help define what types of questions to ask (quantitative, qualitative, comparative, open-ended, etc.) in the survey. For example, open-ended questions tend to get low response rates but can provide unique insights. Comparative questions are good for forcing rankings between concepts but won’t provide any context for how conclusions were drawn.

If your questions are a little too complex for short-form surveys, phone calls are the next best option. Calling a few existing customers can usually be done at little to no expense and can help fill holes in your data set. Even better, if you have a good relationship established with a handful of customers, you can employ the ship-and-call method. For this, you’ll need to ship your prototype to a user, conduct a phone interview with them, and then have your customer ship the prototype to the next user. This a great method for getting prototypes in user’s hands without the added costs of travel, recruitment, and facility fees.

Reaching out to a few power users will help your team validate your product at extremes, but make sure to get in touch with a few users at the other end of the spectrum too. Ensuring your product is usable for the less familiar, casual user is critical to evaluating the intuitiveness of your design.

Use alternative resources in the absence of real users

It’s easy to think of user testing and immediately focus on the target user (the surgeon or factory worker or pilot) but you don’t always need your target user to do adequate user testing. Human factors is one segment of testing that can be accomplished with non-users. It’s more important to have representation at the 5th and 95th percentile than people with deep domain knowledge. Find co-workers, friends, or family who represent the ends of the spectrum and have them provide feedback on the ergonomic feel and fit of your device. They may not be able to tell you if you should have a button, but they can definitely tell you if that button feels right or not.

Finally, if it makes sense for your product, you can employ true guerrilla testing tactics and head out to a public space. For this type of testing, you’ll need to craft a short discussion guide and find a suitable location. Search for an area where you’re likely to find people in your target user group. If you’re designing a pet product, setting up near a pet store probably makes sense. Approach passersby and ask if they have time for a quick product survey. Be polite, be efficient, and express gratitude for their input and time.

Another option is to find and use your internal experts. Most companies have sales reps or training specialists who have unique, in-depth insights into the use of your products. These are the perfect people to run prototypes by for some go-no-go testing.

Build support for future research efforts

After the research is complete, it’s easy to let your team get buried in the mounds of work that inevitably follow. However, it’s important to continue to refer to the output of the research and use it to make trade-off decisions as the project progresses. Doing so ensures that your team’s decisions are rooted in the right context and increases the probability that your product will meet market success.

But, beyond that, constantly referring to your research also provides hard evidence for how impactful and valuable good user data can be. When strategic decisions are founded on real data instead of one person’s opinion, the resulting success isn’t just a haphazard accident. It is structured, planned for, and measurable. Showing how user research ties into these decisions is critical for building future support. Because the more your internal customers come to understand the benefit of research and how it can be leveraged to make good decisions, the more willing they will be to fund it.